In 2008 Michigan voters approved a ballot initiative measure that legalized medical cannabis for patients suffering from serious health issues. Eight years later, in 2016, Michigan’s Legislature passed a law expanding the state’s medical cannabis program permitting the licensing and regulation of medical cannabis businesses.

2018 was a historic year for the State of Michigan, with voters approving an adult-use cannabis legalization measure that was placed on the ballot via a citizen initiative process. It was the culmination of decades of effort by hardworking activists such as Rick Thompson (RIP).

The next major milestone for Michigan’s cannabis movement came in 2019 when adult-use cannabis sales began in Michigan dispensaries. Since that time Michigan has become a national powerhouse for legal cannabis commerce.

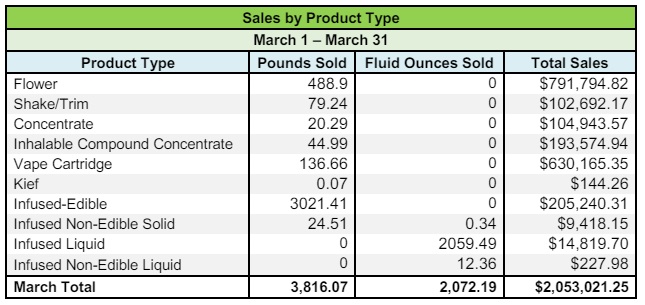

In Michigan’s monthly report for the period March 1-31, 2024, the state listed 213 medical cannabis ‘provisioning centers’ that were permitted to make legal sales to patients. The medical cannabis provisioning centers sold over $2 million worth of medical cannabis products during March 2024. Below is a breakdown by product type:

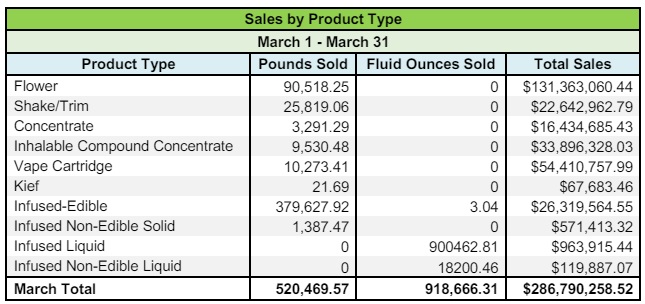

Additionally, the state’s 785 active adult-use cannabis retail license holders sold over $286 million worth of recreational cannabis products – a new state record. Below is a breakdown of sales by product type:

“March’s new overall and adult-use sales figures beat previous records set in December, when Michigan was among a number of states that saw a surge of sales to close out 2023. The state saw more than $3 billion in legal sales for the year.” Marijuana Moment stated in its reporting.

Back in February 2024, the Michigan Department of Treasury announced that it was distributing more that $87 million in tax revenue generated by the state’s emerging legal cannabis industry. Michigan places a 10% excise tax on adult-use sales, in addition to a 6% sales tax. The $87 million was distributed among 269 municipalities.

“For the 2023 state fiscal year, there was more than $290.3 million available for distribution from the Marihuana Regulation Fund.” the Michigan Department of Treasury stated in a press release at the time.

“This week, many Michigan municipalities and counties will begin seeing their share of adult-use marijuana payments appear in their banking accounts,” State Treasurer Rachael Eubanks said. “Through a partnership, the dollars received from the adult-use marijuana taxes and fees are distributed to our participating communities. These dollars may be spent how our local units deem fit to their needs.”

“The tax funding for municipalities and counties that comes from the marijuana excise tax is a very important benefit of the legal cannabis industry in Michigan,” said Cannabis Regulatory Agency (CRA) Executive Director Brian Hanna. “The CRA is committed to doing our part in supporting our licensees so that they can continue to grow the local economy throughout the state with good-paying jobs and increased revenues for local government budgets.”