In a trend that can be found throughout the State of California, local cannabis tax revenues in Santa Barbara County are lower than anticipated. Legal cannabis sales in California continue to underperform as the legal industry battles the still-thriving unregulated market.

“The shortfall for this fiscal year, covering June 2023 through June 2024, will likely be $1.8 million, or 24 percent less than the $7.5 million that was budgeted last June, county officials told the Board of Supervisors on Tuesday. Fiscal year-end cannabis tax revenues are now projected to total $5.7 million — barely enough to cover the $5 million annual cost of ensuring compliance with county regulations and enforcing the law against black market operators.” stated the Santa Barbara Independent in its local coverage.

“Of 57 cannabis operators in the county, 33 reported their gross revenues for the third quarter and 20 reported zero revenues, indicating they were not harvesting from January through March, according to the CEO’s report to the board. Four operators did not file tax reports, officials said, and their county business licenses will not be renewed.” the Santa Barbara Independent also stated.

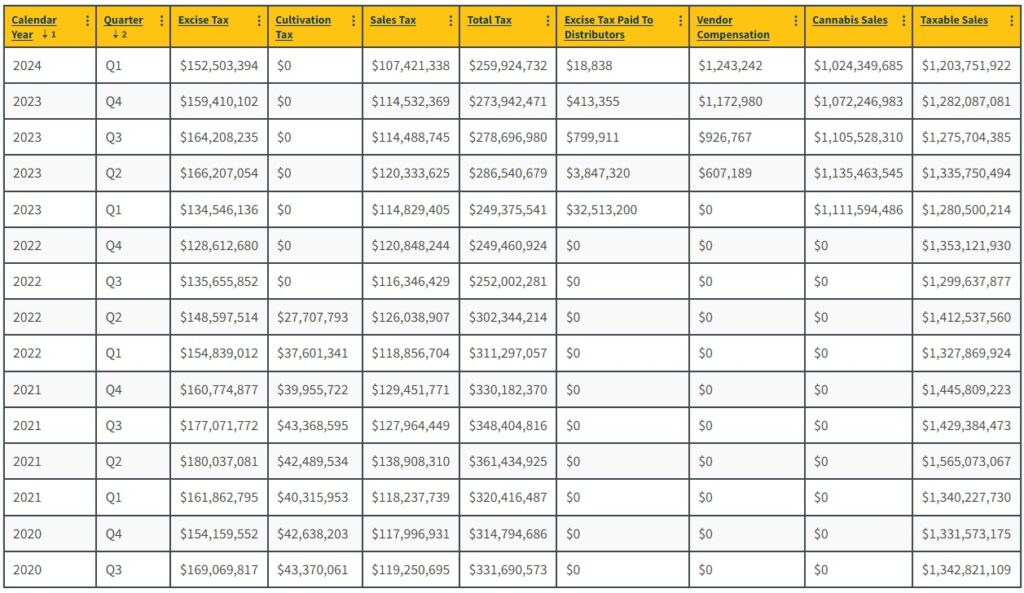

The 2024 Q1 sales totals in California are the lowest since the second quarter of 2020 when total sales were roughly $1.1 billion. Sales totals peaked in California in 2021 Q2 when the state’s legal cannabis industry sold over $1.5 billion worth of products.

California is still the national leader for floral hemp production by far.

“According to the USDA, more than 11 million pounds of hemp flower was produced in 2022 by 1,800 American farms covering about 10,500 acres. California produced 56% of all U.S. hemp flower, which is used to extract CBD and other cannabinoids, including intoxicating hemp-derived THC.” MJBiz Daily stated in its initial coverage.

Kentucky produces the second most floral hemp flower in the United States (1,764,736 lbs.), followed by Oregon (663,370 lbs.), and Colorado (455,100). Alameda County in California produced 5,531,832 pounds in 2022 alone.

The United States adult-use cannabis industry has generated over $20 billion in total tax revenue since the first legal recreational cannabis purchase was made in Colorado on January 1st, 2014 according to a recent report by the Marijuana Policy Project.

“Through the first quarter of 2024, states have reported a combined total of more than $20 billion in tax revenue from legal, adult-use cannabis sales. In 2023 alone, legalization states generated more than $4 billion in cannabis tax revenue from adult-use sales, which is the most revenue generated by cannabis sales in a single year.” the Marijuana Policy Project stated in a press release.

Total legal cannabis sales in the United States are expected to reach $31.4 billion in 2024 according to a recent analysis by Whitney Economics. Additionally, leading cannabis jobs platform Vangst, in conjunction with Whitney Economics, estimates that the legal cannabis industry now supports 440,445 full time-equivalent cannabis jobs in the United States.

Whitney Economics also projects the following legal cannabis sales figures in the United States for the coming years:

- 2024: $31.4 billion (9.1% growth from 2023)

- 2025: $35.2 billion (12.1% growth from 2024)

- 2030: $67.2 billion

- 2035: $87.0 billion

The emerging legal cannabis industry in the United States is projected to add roughly $112 billion to the nation’s economy in 2024 according to a newly released analysis by MJBiz Daily. The projection is part of the company’s 2024 MJBiz Factbook.

“The total U.S. economic impact generated by regulated marijuana sales could top $112.4 billion in 2024, about 12% more than last year,” MJBiz stated in its initial reporting.